Yes. You need personal health insurance even if your company offers one. Let’s understand why.

Table of Contents

- Benefits of Corporate Insurance for Employers

- Benefits of Corporate Insurance for Employees

- Personal Health Insurance vs. Corporate Insurance

- The Bottom Line

Health Is Wealth.

Amidst growing financial awareness and uncertainties akin to a pandemic, the general public recognizes the importance of creating a medical safety net. Aligning financial necessities with sound corporate practices, the popularity of group health insurance is on the rise. Corporate health insurance offers several benefits to employers and employees. Here are some key advantages of group insurance:

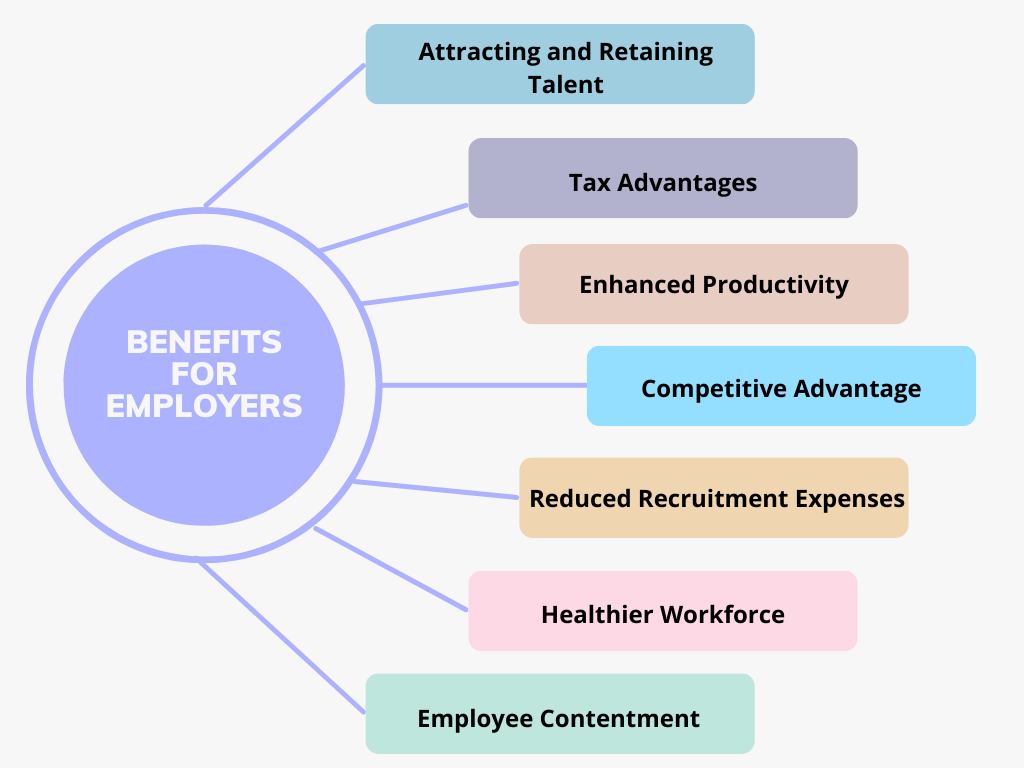

Benefits of Corporate Insurance for Employers

- Attracting and Retaining Talent: Health insurance included in the employee benefits package is a valuable tool for attracting top-tier talent to your organization and retaining existing skilled employees. Many job seekers prioritize health coverage as a crucial factor when selecting an employer.

- Tax Advantages: In numerous countries, including India, the premiums paid for employee health insurance are eligible for tax deductions as a business expense, resulting in potential cost savings for the company.

- Enhanced Productivity: Generally, employees in good health tend to be more productive. Access to regular healthcare reduces the likelihood of work absences due to illness or health-related issues.

- Competitive Advantage: Health insurance can give your company a competitive edge in the job market, differentiating you from competitors who do not extend such benefits.

- Reduced Recruitment Expenses: Employees with access to health insurance are less inclined to seek opportunities elsewhere solely for better benefits. This can lead to decreased costs associated with recruiting and training new staff.

- Healthier Workforce: Regular health check-ups and preventive care contribute to early detection and management of health issues, fostering a healthier and more engaged workforce.

- Employee Contentment: Providing health insurance communicates a genuine concern for your employees’ well-being, increasing overall job satisfaction and morale.

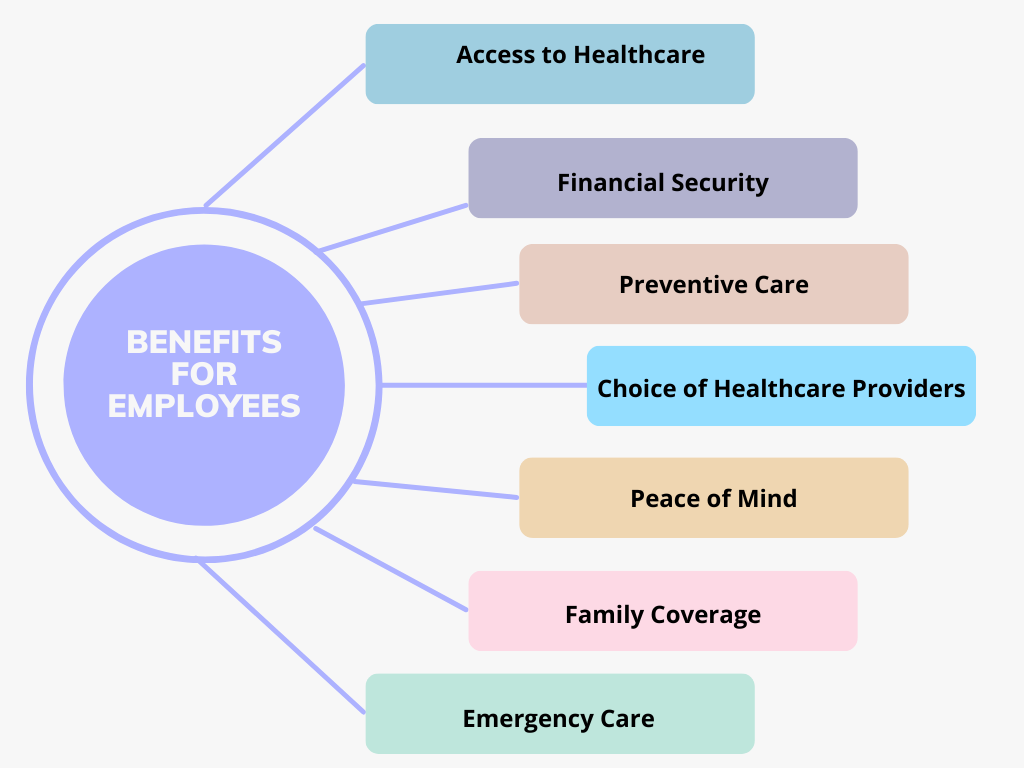

Benefits of Corporate Insurance for Employees

- Access to Healthcare: Employees and their dependents can receive medical care, including doctor visits, hospitalization, and prescription medications, without significant out-of-pocket expenses.

- Financial Security: Health insurance provides a safety net in case of unexpected medical expenses. It can protect employees from the economic burden of high healthcare costs.

- Preventive Care: Many corporate health insurance plans cover preventive services like vaccinations and wellness check-ups, helping employees stay healthier in the long run.

- Choice of Healthcare Providers: Employees often have a selection of healthcare providers and hospitals within the network, allowing them to receive care from preferred doctors and facilities.

- Peace of Mind: Knowing they have health insurance coverage can provide employees with peace of mind, reducing stress related to healthcare expenses.

- Family Coverage: Many corporate health insurance plans offer coverage for employees’ family members, providing security for their loved ones.

- Emergency Care: Health insurance ensures that employees receive timely medical care in emergencies, which can be crucial for their well-being.

It is important to note that corporate health insurance plans’ specific benefits and coverage options can vary widely. It is essential for both employers and employees to carefully review the details of their particular plan to understand what is covered and any associated costs or limitations.

Personal Health Insurance vs. Corporate Insurance

Corporate and personal health insurance are two distinct types of health coverage, each with its characteristics, advantages, and considerations. Here’s a comparison of these two types of health insurance:

| Characteristics | Corporate Insurance | Personal Health Insurance |

| Sum Insured | Fixed; often insufficient for serious illness | Customizable as per the need |

| Top Up | Possible | Possible |

| Validity | Till employed by the current employer | Till you pay your premium. Depending upon the service provider, you can continue this plan for a lifetime |

| Cost Sharing | Employers often subsidize a portion of the premium cost for employees, reducing the financial burden on individuals. Employees typically contribute through payroll deductions | The onus of complete payment lies on the insured |

| Ease of Operation | It is pretty easy, as you don’t have to remember renewal deadlines | You have to pay a premium on time to avoid policy lapse |

| Flexibility | There is no flexibility, as customization isn’t possible. Also, there isn’t any option for porting the policy | The flexibility of choosing add-ons as required. Policy portability allows you to select a better insurer if the need arises |

| Retirement Planning | No coverage once you retire. The cost of availing of health insurance at that age may be high as premiums increase with age and associated risks | It is the best investment at lower prices for thoughtful retirement planning |

| Benefits Carry Forward | You lose all the benefits when you leave the company | Benefits like coverage of pre-existing disease, no-claim bonus, etc., stay with you even if you port the policy |

| On-Call Consultation | Most corporate health insurance provide free-of-cost online consultations. It saves a lot of money as well as time | Personal health insurance has a lower cap on out-patient consultations (Usually Rs. 300-500/-), which is insufficient in today’s time |

| Ease of Second Opinion | It may be difficult as the company retains the rights to reports | It is easier as you get a copy of your reports |

| Options for Cashless Hospitalization | It is generally limited, and your preferred hospital may be impanelled only on a reimbursement basis | It generally impanels all the reputed hospitals on a cashless basis |

| Add-ons | It generally includes benefits like dental, ophthalmic, laser treatment, etc. | It may offer treatments like dental, ophthalmic, laser, etc., at an additional cost |

| Tax Benefits for Employees | No tax benefits | You can claim tax benefits if you choose the old tax regime |

The Bottom Line

The decision between corporate and personal health insurance hinges on individual circumstances and priorities. Individuals with access to both types of coverage can opt to complement their employer-sponsored plan with personal insurance, thereby obtaining additional coverage and flexibility.

Also read: Top 6 Criteria for Choosing the Best Health Insurance For Women