The exceptional returns offered by stock markets in the past three years, coupled with talks about financial literacy, are changing the Indian investing landscape. Indians are opening new Demat accounts at a 12-month average of 3.66 million. These numbers are astonishing.

The proliferation of information and the accessibility of different investment tools have created opportunities and challenges for both seasoned and novice investors. This landscape is characterized by a wide array of options, including fixed deposits (FDs) and bonds, stocks, mutual funds, gold, and alternative investments like cryptocurrency, securitized debt instruments, etc. Each of these vehicles offers unique features, benefits, and risks that potential investors must understand to maximize benefits.

Mutual funds beyond FDs have emerged as a compelling option for those looking to diversify their portfolios without needing extensive market knowledge. They pool resources from multiple investors to purchase a diversified basket of stocks, bonds, or other securities. This collective investment approach mitigates risk somewhat, making mutual funds especially suitable for beginners who may lack the expertise to analyze individual securities or passive investors. The professional management inherent in mutual funds allows investors to benefit from the skills of seasoned portfolio managers, enhancing the potential for returns while providing relatively lower volatility compared to direct stock investments.

Moreover, the current trend toward digital platforms and robo-advisors has simplified the process of investing in mutual funds, allowing budding investors to explore this avenue with greater ease. Comparatively, FDs provide a safer, fixed return with minimal risk but at the cost of lower potential gains. In contrast, stocks can yield higher returns through capital appreciation but involve significantly greater risk. Understanding these distinctions is crucial for novices aiming to make prudent investment choices. By exploring mutual funds alongside other investment vehicles, beginners can configure a well-rounded portfolio that aligns with their financial goals and risk tolerance.

Table of Contents

- 5 Things to Consider Before Starting Your Investing Journey

- Investing 101 Mutual Funds: Are Mutual Funds Really Better than FDs and Stocks?

- Types of Mutual Funds

- How to Start Investing in Mutual Funds

- Conclusion: Shaping the Future of Your Investments

5 Things to Consider Before Starting Your Investing Journey

Embarking on an investment journey requires careful thought and planning.

- One of the first considerations is assessing your risk tolerance, which greatly influences your investment choices. It is essential to understand whether you are conservative, moderate, or aggressive in terms of risk preference and, thus, return expectations. Establishing a clear picture of your comfort levels will guide you in selecting suitable investment vehicles, from mutual funds to stocks.

- Next, understanding your financial goals is paramount. Are you investing for retirement, purchasing a home, or funding education? Defining these objectives will help you determine the appropriate investment strategy. Each goal may have different timelines and associated risks, making it important to align your investment approach with your specific aspirations.

- Diversification is a critical principle in successful investing. Spreading investments across various asset classes, sectors, or geographic regions can mitigate risks and enhance potential returns. By diversifying your portfolio, you avoid the pitfalls of putting all your eggs in one basket, which can lead to significant losses if your chosen investment underperforms.

- The role of time horizon cannot be overlooked in your investing strategy. The time you plan to stay invested can substantially impact performance and risk tolerance. Longer investment horizons tend to allow more time to recover from market fluctuations, while shorter ones may necessitate a more conservative approach.

- Finally, the necessity of ongoing education about market trends is crucial for any investor. Staying informed about economic indicators, market dynamics, and investment strategies is essential to make informed decisions. With continuous learning, investors can adapt to changing market conditions and refine their approaches, leading to potentially more successful outcomes.

Investing 101 Mutual Funds: Are Mutual Funds Really Better than FDs and Stocks?

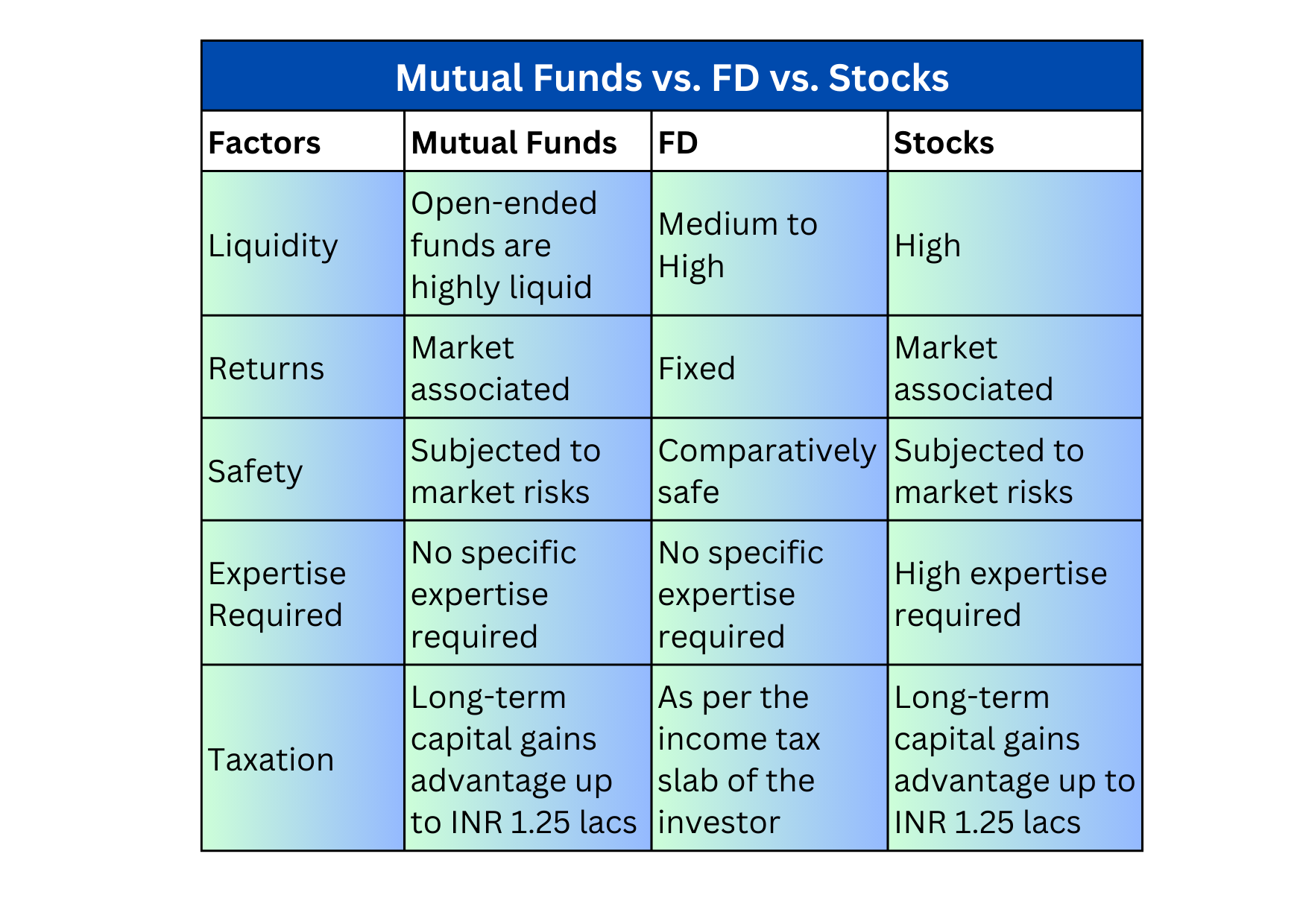

When contemplating investment options, it is essential to understand the distinctions between mutual funds, fixed deposits (FDs), and stocks. Each investment tool carries its unique set of advantages and disadvantages. Comprehending these differences can guide investors toward making informed decisions tailored to their financial goals.

Fixed deposits are often preferred by risk-averse investors seeking guaranteed returns. They offer a predetermined interest rate over a fixed tenure, ensuring capital protection. However, this comes at the cost of lower returns compared to other investment types. Also, withdrawing funds prematurely from an FD often leads to penalties that reduce overall gains.

On the other hand, stocks present high return potential but accompany significant risk. Investing in equities requires substantial market knowledge and an understanding of stock trends, making stocks less suitable for novice investors. The volatile nature of the stock market can lead to impulsive decisions, leading to substantial losses, yet it also offers opportunities for rapid wealth generation, appealing to those willing to embrace risk for higher-end returns.

Mutual funds bridge the gap between FDs and stocks, offering a balanced approach to investing. They pool money from multiple investors and allocate it across various assets, including stocks, bonds, and other securities, thereby diversifying risk. This diversification is advantageous as it mitigates the impact of poor-performing assets on the overall investment portfolio. However, the returns on mutual funds can vary widely depending on the underlying assets and market conditions.

In terms of liquidity, mutual funds typically allow investors to redeem returns relatively easily, making them a more flexible option compared to FDs. Moreover, mutual funds are managed by finance professionals, which diminishes the knowledge requirement for individual investors. Given these factors, mutual funds may indeed represent a reliable and advantageous investment choice for those looking to diversify their portfolios while maintaining a balance of risk and return.

Types of Mutual Funds

Investing in mutual funds is an effective way to diversify your portfolio and gain exposure to various asset classes. There are several types of mutual funds available in the market, each designed to meet different investment objectives and risk profiles.

Equity funds primarily invest in stocks and aim to provide capital appreciation. They are suitable for investors with a higher risk tolerance, as they can be volatile but have the potential for higher returns over the long term. Within equity funds, you can find subcategories like large-cap, mid-cap, and small-cap funds that focus on companies of varying sizes based on their market share.

Debt funds invest in fixed-income securities like government bonds, corporate bonds, and other debt instruments. They are ideal for conservative investors seeking regular income and lower volatility. Debt funds are classified based on their duration, such as short-term, medium-term, and long-term funds, providing options to cater to different investment horizons.

Hybrid funds combine both equity and debt instruments, allowing investors to enjoy the benefits of both worlds. They can range from conservative hybrid funds, which have a higher allocation to debt, to aggressive hybrid funds, which favor equities more. This balance helps in risk management while targeting capital growth.

Index funds are designed to replicate the performance of specific market indices, such as the Nifty 50 or the Sensex. These funds offer a passive investment strategy, usually with lower expense ratios compared to actively managed funds, making them appealing to cost-conscious investors.

How to Start Investing in Mutual Funds

To start investing in mutual funds, first, assess your financial goals and risk appetite. Research various mutual fund schemes and consider factors such as historical performance, fund manager credentials, and expense ratios. Once you’ve identified suitable funds, you can invest through platforms such as the mutual fund house’s website, online brokers, or financial advisors. Many platforms now offer systematic investment plans (SIPs), which allow you to invest small amounts regularly, making investing more manageable.

Conclusion: Shaping the Future of Your Investments

Investing is no longer confined to a one-size-fits-all approach. With options like mutual funds, fixed deposits, and stocks, today’s investors have the flexibility to tailor their portfolios according to their goals, risk tolerance, and financial timelines. Mutual funds, in particular, offer a balanced middle ground, combining professional management with diversification and liquidity, making them ideal for both beginners and experienced investors.

The evolving investing landscape, driven by digital platforms and growing financial literacy, presents exciting opportunities. Equip yourself with knowledge, assess your needs, and diversify wisely to build a portfolio that stands the test of time. Your journey to wealth creation and stability starts with the right investment decisions today.

Also read, 5 Best Investments For Higher Returns On Savings.

Disclaimer:

This website is created and authored by Bhumica Agarwal and is published and provided for informational and entertainment purposes only. The information in the Blog constitutes the Content Creator’s own opinions (and any guest bloggers posting from time to time) and it should not be regarded as a description of services or recommendations.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this Blog constitutes investment advice, performance data, or any recommendation that any security, portfolio of securities, investment product, transaction, or investment strategy is suitable for any specific person. From reading this Blog we cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you, so any opinions or information contained on this Blog are just that – an opinion or information. You should not use this Blog to make financial decisions, and we highly recommend you seek professional advice from someone who is authorized to provide investment advice.

Any indices referenced for comparison are unmanaged and cannot be invested directly. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. We like to share links to articles and information which is interesting to us. It is in no way an endorsement by us or by anyone associated with us.